MORTGAGE RATES

7 Factors that Impact The Cost of Your Mortgage

The right or wrong mortgage can change a person’s financial future, but sadly most people spend more time picking their paint colors than choosing their mortgage.

A mortgage is one of the largest financial transactions you will undertake and most people shop by spending five minutes searching rates online. What they don’t understand is that there are multiple factors that impact mortgage costs, the lowest rate doesn’t always mean the lowest payment or the lowest cost mortgage.

Want to bypass 6 factors and just see today’s rates? Scroll down to find an estimated rate calculator.

Want to shop all 7 factors like a pro? Call us now at (208) 388-0500. We will spend a few minutes on a virtual meeting with you. During this short meeting, we will create a personalized cost analysis that will help you understand all 7 factors as they pertain to you and how you can save you thousands over the life of your loan.

Here are the factors that will go into your personal cost analysis:

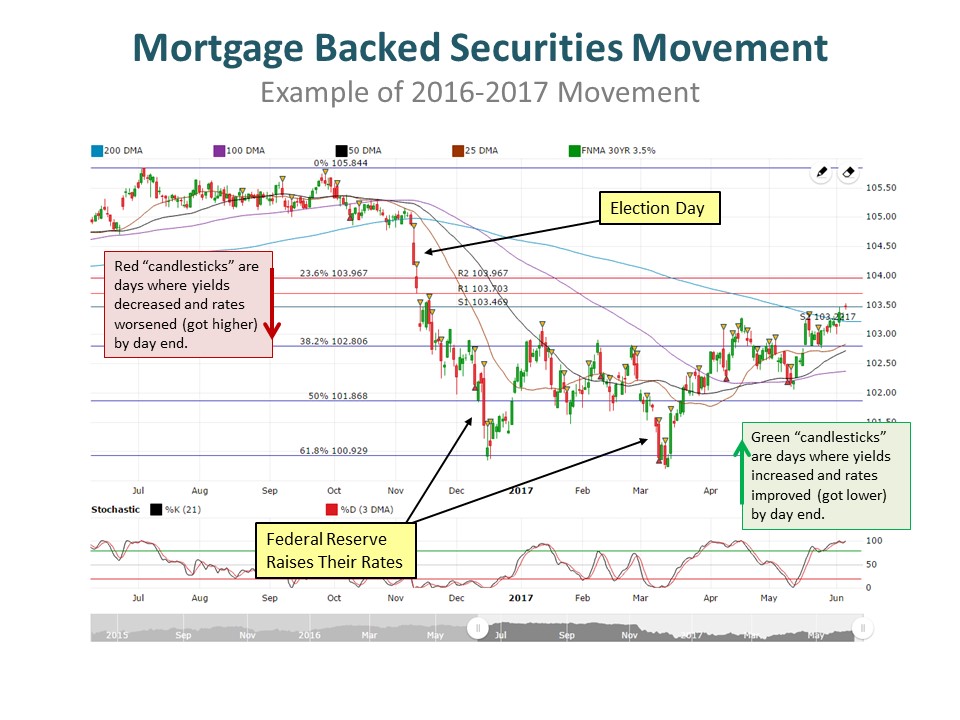

- The Mortgage Market: Learn what economic factors can cause mortgage rates to change multiple times every day and how to protect your rate quote. The lowest internet rate quote doesn’t mean anything if you can’t actually lock that rate.

- Risk Based Pricing: You may realize your interest rate is impacted by your credit score but did you know that there are actually 30 different factors that can impact your interest rate? Learn a few simple things that you can do to get a better rate.

- Points & Origination Fees: Learn how to analyze the cost of points so that you can make an educated decision about paying for points and origination fees.

- Mortgage Insurance (MI): Learn about the 10+ ways that mortgage insurance can be structured so that you can save money by picking an option that takes into consideration long-term “MI” costs.

- Loan Term: Learn about the big picture cost of a mortgage and how to save money over the life of the loan without sacrificing the safety of a low monthly payment. Learn how to decipher the contradicting advice of financial gurus such as Dave Ramsey and Ric Edelman so you can make a decision that matches your overall financial strategy.

- Home Prices: Learn how to understand the Home Price Expectation Survey as an indicator of where home prices are headed and how this can impact your costs. Factored along side rate predictions you will learn how to think about the “price” of the home versus the “cost” of the home.

- Closing On Time: Learn about the cost of closing late and what you can do to avoid losing thousands of dollars in earnest money, appraisal fees, home inspection fees and more!

While we cannot provide an online rate quote that takes into consideration all of these 7 factors, we can give you a general idea of where rates are today. To obtain a “quick” ballpark rate quote, just follow the link below to answer a few questions about your credit score, loan amount, and location.

https://www.consumerfinance.gov/owning-a-home/explore-rates/

Once you’ve reviewed the estimated rate quote, give us a call for your personalized money-saving analysis (208) 388.0500.